[ad_1]

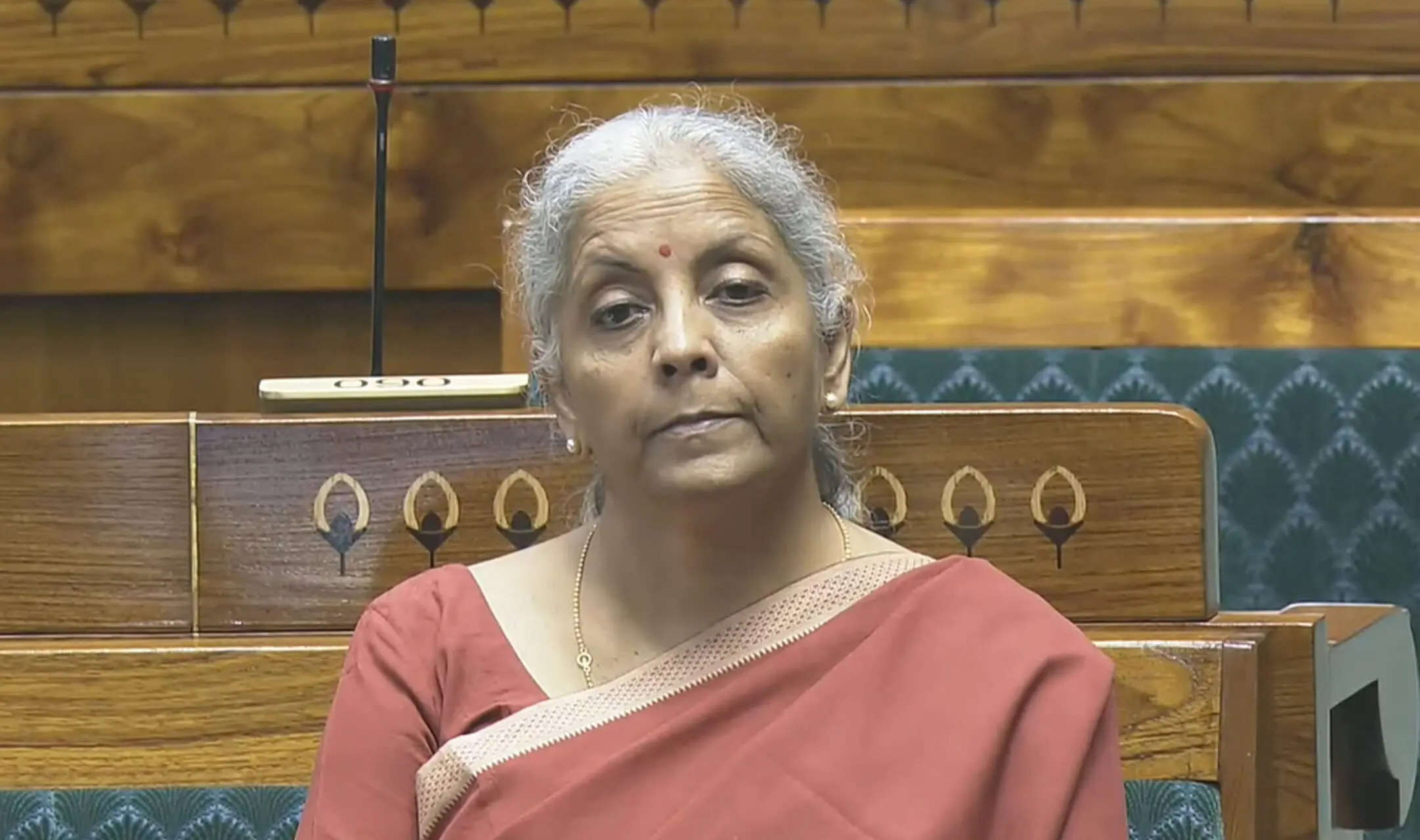

NEW DELHI: The opposition slammed the tax proposals within the finance invoice as an try to squeeze each penny out of the poor and salaried class whereas sparing the wealthy, with Congress MP Amar Singh initiating the talk in Lok Sabha by difficult finance minister Nirmala Sitharaman to indicate one proposal that helps the frequent man.

Singh stated the FM skirted the talk on unemployment and inflation in her speech, that are breaking the again of the center class and the poor.He stated the revenue tax is larger than the company tax, asking, “Who’s govt working for?”. He stated the World Inequality Report has revealed that 1% of the richest folks in India have 40% of the wealth. Singh stated govt should inform what number of jobs had been created due to the slashing of the company tax.

SP’s Ramashankar Rajbhar, Congress’s Tanuj Punia, CPI (ML) Sudama Prasad, YSRCP’s Avinash Reddy, NCP’s Supriya Sule, Shiv Sena’s Anil Desai amongst others additionally spoke on the finance invoice.

Amar Singh stated the FM ought to exempt from the IT bracket the residents incomes as much as Rs 5 lakh revenue, arguing it is not going to damage govt however enhance consumption.

Congress’s Deepender Hooda stated the company tax was slashed from 30% to 22% within the title of accelerating funding, however funding has fallen sharply. He added that FDI is on the lowest in 16 years, as he painted a grim image of the economic system.

TMC’s Mahua Moitra and Hooda each criticised that about 65% of tax assortment comes from oblique taxes, that are similar for super-rich and poorest inhabitants.

Mahua stated the FM has made a mockery of individuals by doing “completely nothing” within the price range, barring some regressive proposals. “You may have saved the identical Cupboard, the identical finance minister, who has given the identical shoddy price range,” she stated. “Who is that this price range for? The center class makes up 31% of India and the poor account for 60-65%,” she claimed.

TDP MP Lavu Sri Krishna Devarayalu known as for removing of the retrospective tax which he stated was having a detrimental influence on varied industries. NCP’s Supriya Sule demanded withdrawal of GST on life and medical insurance coverage premium.

Singh stated the FM skirted the talk on unemployment and inflation in her speech, that are breaking the again of the center class and the poor.He stated the revenue tax is larger than the company tax, asking, “Who’s govt working for?”. He stated the World Inequality Report has revealed that 1% of the richest folks in India have 40% of the wealth. Singh stated govt should inform what number of jobs had been created due to the slashing of the company tax.

SP’s Ramashankar Rajbhar, Congress’s Tanuj Punia, CPI (ML) Sudama Prasad, YSRCP’s Avinash Reddy, NCP’s Supriya Sule, Shiv Sena’s Anil Desai amongst others additionally spoke on the finance invoice.

Amar Singh stated the FM ought to exempt from the IT bracket the residents incomes as much as Rs 5 lakh revenue, arguing it is not going to damage govt however enhance consumption.

Congress’s Deepender Hooda stated the company tax was slashed from 30% to 22% within the title of accelerating funding, however funding has fallen sharply. He added that FDI is on the lowest in 16 years, as he painted a grim image of the economic system.

TMC’s Mahua Moitra and Hooda each criticised that about 65% of tax assortment comes from oblique taxes, that are similar for super-rich and poorest inhabitants.

Mahua stated the FM has made a mockery of individuals by doing “completely nothing” within the price range, barring some regressive proposals. “You may have saved the identical Cupboard, the identical finance minister, who has given the identical shoddy price range,” she stated. “Who is that this price range for? The center class makes up 31% of India and the poor account for 60-65%,” she claimed.

TDP MP Lavu Sri Krishna Devarayalu known as for removing of the retrospective tax which he stated was having a detrimental influence on varied industries. NCP’s Supriya Sule demanded withdrawal of GST on life and medical insurance coverage premium.

[ad_2]

This Put up could comprise copywrite