[ad_1]

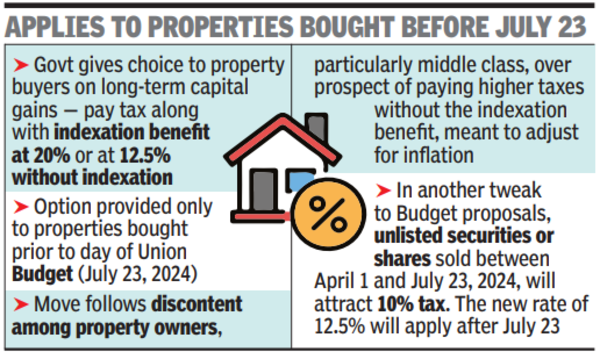

The transfer follows issues amongst center class and different property homeowners that they’d be deprived beneath the brand new regime which does away with indexation profit, meant to regulate for inflation, whereas decreasing the tax price from 20% to 12.5% as a part of an train to make sure that all asset lessons face the identical levy as a substitute of a number of charges.

Though tax authorities in addition to Sitharaman had sought to allay fears and argued that individuals gained’t be worse off beneath new dispensation, the govt. selected to take away an irritant in a price range welcomed on most different counts. A number of specialists had argued that adjustments would influence older properties extra.

The change in capital positive factors tax method for actual property virtually ended up burying the acquire of Rs 17,500 that might accrue to taxpayers with following the change in slabs beneath the brand new tax regime.

‘Govt lets you select finest realty tax choice’

Sudhir Kapadia, senior adviser, tax and regulatory providers, at consulting agency EY India, stated, “Govt has given even higher aid and allowed individuals to decide on what’s finest for them. It has sought to make sure that beneath no circumstance is anybody worse off.”

Lately govt has opted to “grandfather” tax adjustments, permitting the brand new guidelines to use prospectively, however this was one uncommon occasion of the Centre searching for to implement adjustments which didn’t give people time to regulate, particularly in an asset class the place there’s a time lag between the time a transaction is executed and the precise registration of the sale deed.

“By enabling taxpayers to decide on the decrease tax burden between the brand new and previous schemes, the modification is poised to drive funding and improve gross sales throughout housing segments. We’re grateful for the FM’s forward-thinking method in implementing these helpful measures,” stated Niranjan Hiranandani, chairman of the Hiranandani Group and NAREDCO, the business foyer group.

Individually, govt may also present that unlisted securities or shares bought between April 1 and July 23, 2024 will appeal to 10% tax and that solely after July 23 will the brand new price of 12.5% capital positive factors be carried out.

[ad_2]

This Publish might include copywrite