[ad_1]

Buyers felt that their good points had been taken away in a single day by the federal government’s actions. Nonetheless, the query stays: have gold buyers really been disadvantaged of their income?

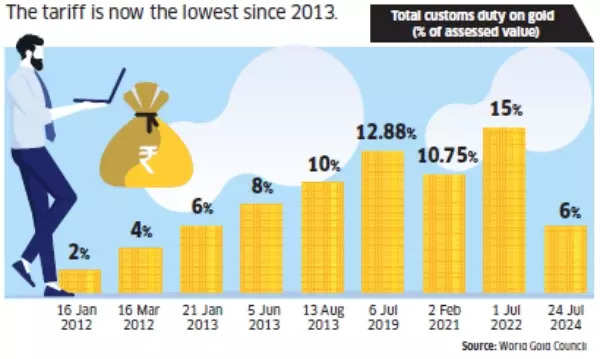

An ET report quotes Kavita Chacko, Analysis Head, India, World Gold Council, saying, “That is the sharpest discount on file and the bottom since June 2013.” Though the obligation reduce led to a big decline in gold costs, in addition to gold bond and ETF costs, the affect on varied gold bonds differed, with some experiencing solely a slight 1-3% lower.

Elements similar to time remaining till bond maturity, buying and selling volumes, and the premium at which the bond was buying and selling earlier than the Finances influenced the extent of the affect.

Mrin Agarwal, Founder Director, Finsafe India, asserts, “The affect of the obligation reduce on the worth of gold has been overstated.”

The Indian authorities’s choice to cut back import obligation on gold will not be a random transfer however part of its coverage framework to handle the nation’s present account deficit and shield the rupee, says the ET report. The latest reduce was aimed toward curbing the rising smuggling of gold into India, which had grow to be extra engaging because of the earlier obligation hikes making it costly to purchase the yellow steel by means of authorized channels.

Gold customs obligation

Chacko mentioned, “The customs obligation discount will make gold imports through unofficial channels much less (and even non-) worthwhile.”

Moreover, the obligation reduce was supposed to spice up India’s exports of gems and jewelry, which had been experiencing a slowdown as a consequence of weak international demand.

Chirag Mehta, CIO, Quantum AMC, was quoted as saying, “India is a worth taker in gold. The prevailing elevated obligation construction— widening the differential between international and home gold costs—was distorting the market considerably.” The duties had been beforehand raised to regulate gold imports when India’s commerce deficit was excessive, however the scenario will not be as extreme now.

It’s essential to contemplate the import obligation discount within the context of the previous 12 years. Throughout this era, the import obligation on gold has steadily elevated from 2% in January 2012 to fifteen% in July 2022, with just one discount in between. Obligation hikes have been considerably extra widespread than cuts, and every hike has resulted in a rise within the home worth of gold, in addition to the traded worth of gold ETFs and SGBs.

Whereas buyers have skilled a loss because of the latest reduce, they’ve additionally benefited from earlier obligation hikes. Primeinvestor.in factors out that when the primary SGB was launched in November 2015, the import obligation on gold was 10%. This was subsequently raised to 12.8% in July 2019, lowered to 10.75% in February 2021, after which elevated once more to fifteen% in July 2022. These two hikes boosted home gold costs, enabling buyers to acquire larger values for his or her SGBs and gold ETFs. Moreover, two tranches of SGBs have been redeemed at these elevated costs when the 15% import obligation was in impact.

Additionally Examine | New Tax Regime 2023 vs 2024 After Budget: How Much Income Tax Will Salaried Taxpayers Save?

For buyers who wanted to promote their holdings to cowl bills, this drop is important. Buyers in Sovereign Gold Bonds (SGBs) really feel notably affected by this reduce, with some believing that the federal government intentionally lowered the import obligation to decrease its payout to buyers of SGBs maturing within the coming months. Nonetheless, it is a misinterpretation, because the reduce impacts buyers in all gold devices equally, not simply SGBs, in accordance with Agarwal.

Furthermore, the financial savings the federal government will make on its outgo on SGB redemptions will likely be minimal, as famous by Primeinvestor.

Whereas buyers fear that future obligation modifications will proceed to affect gold investments, those that maintain for longer intervals might get better a few of the losses.

“If you happen to hold on to your SGBs until maturity, the loss from the customs obligation reduce will be made up by different elements that spike international gold costs or weaken the rupee,” argues the Primeinvestor word.

In reality, the valuable steel has already regained a few of its misplaced worth. Customs obligation is simply a minor issue influencing native gold costs, with different variables similar to worldwide gold costs, demand-supply of gold, and rupee-dollar change fee having a extra important affect, as identified by Agarwal. Worldwide gold costs are influenced by elements just like the power of the greenback, geopolitical tensions, inflation, and central financial institution purchases, amongst others.

Specialists keep that gold stays a compelling funding choice, no matter any obligation modifications. Mehta asserts, “Gold retains its defining traits as a portfolio diversifier, retailer of worth and supply of liquidity. It is going to proceed to supply stability when different danger property decline.”

[ad_2]

This Put up might comprise copywrite