[ad_1]

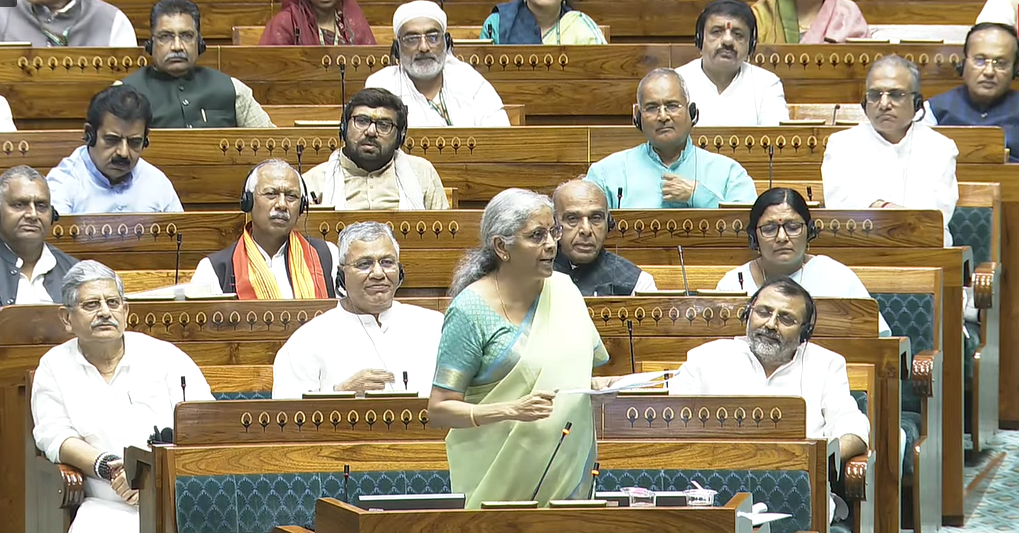

Union finance minister Nirmala Sitharaman criticised the opposition for saying that the price range didn’t assist the salaried and center lessons however solely benefited the rich.

She identified that the federal government has labored to make taxes easier and lighter, particularly in the course of the Covid pandemic when no new taxes have been added.

She additionally criticised the opposition’s demand to take away the 18% GST on life and medical insurance coverage.

On medical insurance coverage 18% GST

Talking within the Lok Sabha, she defined that after a letter from a sure minister was made public, different ministers started calling for the removing of this GST.

The finance minister slammed opposition on the demand for asking removing of 18% GST on medical insurance coverage and mentioned, “A protest was held exterior the parliament, with all events taking part to help the demand.”

She added, “Because the letter got here in public through another person… they protested within the Parliament with 200 MPs to demand removing of GST. I need to elevate two necessary factors – tax has been there on medical insurance coverage even earlier than the introduction of GST. There was already a pre-GST tax on medical insurance coverage earlier than the GST was launched. This isn’t a brand new concern, it was already there in all of the states. These protesting right here… did they focus on concerning the removing of this tax of their states?”

On center class

Sitharaman highlighted a number of measures aimed toward benefiting the center class, together with an elevated normal deduction for salaried staff from Rs 50,000 to Rs 75,000, offering tax reduction of as much as Rs 17,500.

Moreover, private revenue tax slabs have been considerably liberalised in 2023, decreasing tax legal responsibility by Rs 37,500 for taxpayers. The exemption restrict for capital positive aspects on sure listed monetary property has been raised from Rs 1 lakh to Rs 1.25 lakh per 12 months, and the deduction for household pension has been elevated from Rs 15,000 to Rs 25,000, benefiting round 4 crore salaried people and pensioners.

On different price range measures

The Finance Minister additionally introduced further price range measures, together with capital positive aspects tax reduction for property transactions and the abolition of angel tax to help startups. An modification to the Finance Invoice proposes a selection between a decrease tax fee of 12.5% with out indexation or a better fee of 20% with indexation for properties acquired earlier than July 23, 2024.

The passage of the Finance Invoice will full the price range course of, following the Appropriation Invoice for the central authorities’s expenditure for 2024-25. Sitharaman’s presentation of the Union Finances 2024 marks her seventh consecutive price range, surpassing the late Moraji Desai’s document of six consecutive budgets. The price range session of Parliament, which started on July 22, is scheduled to finish on August 12.

She identified that the federal government has labored to make taxes easier and lighter, particularly in the course of the Covid pandemic when no new taxes have been added.

She additionally criticised the opposition’s demand to take away the 18% GST on life and medical insurance coverage.

On medical insurance coverage 18% GST

Talking within the Lok Sabha, she defined that after a letter from a sure minister was made public, different ministers started calling for the removing of this GST.

The finance minister slammed opposition on the demand for asking removing of 18% GST on medical insurance coverage and mentioned, “A protest was held exterior the parliament, with all events taking part to help the demand.”

She added, “Because the letter got here in public through another person… they protested within the Parliament with 200 MPs to demand removing of GST. I need to elevate two necessary factors – tax has been there on medical insurance coverage even earlier than the introduction of GST. There was already a pre-GST tax on medical insurance coverage earlier than the GST was launched. This isn’t a brand new concern, it was already there in all of the states. These protesting right here… did they focus on concerning the removing of this tax of their states?”

On center class

Sitharaman highlighted a number of measures aimed toward benefiting the center class, together with an elevated normal deduction for salaried staff from Rs 50,000 to Rs 75,000, offering tax reduction of as much as Rs 17,500.

Moreover, private revenue tax slabs have been considerably liberalised in 2023, decreasing tax legal responsibility by Rs 37,500 for taxpayers. The exemption restrict for capital positive aspects on sure listed monetary property has been raised from Rs 1 lakh to Rs 1.25 lakh per 12 months, and the deduction for household pension has been elevated from Rs 15,000 to Rs 25,000, benefiting round 4 crore salaried people and pensioners.

On different price range measures

The Finance Minister additionally introduced further price range measures, together with capital positive aspects tax reduction for property transactions and the abolition of angel tax to help startups. An modification to the Finance Invoice proposes a selection between a decrease tax fee of 12.5% with out indexation or a better fee of 20% with indexation for properties acquired earlier than July 23, 2024.

The passage of the Finance Invoice will full the price range course of, following the Appropriation Invoice for the central authorities’s expenditure for 2024-25. Sitharaman’s presentation of the Union Finances 2024 marks her seventh consecutive price range, surpassing the late Moraji Desai’s document of six consecutive budgets. The price range session of Parliament, which started on July 22, is scheduled to finish on August 12.

[ad_2]

This Publish might include copywrite