[ad_1]

Through the announcement of the corporate’s monetary outcomes for the primary quarter, Mohanty stated that the corporate is taking a look at an acquisition in the course of the present monetary 12 months. “Reasonably than arrange a vertical for insurance coverage, we felt that we will purchase an organization which can enable us to start out promoting medical insurance throughout the nation,” stated Mohanty.

LIC has over 14.1 lakh brokers, which is among the many largest company drive amongst insurance coverage firms worldwide.In keeping with sources, a lot of the company’s brokers are already distributing medical insurance for different non-public firms as rules allow an agent to work for all times and non-life firms. These brokers are anticipated to modify to promoting LIC merchandise.

Business sources stated that medical insurance is more and more turning into a ‘pull’ product, with many younger patrons actively in search of protection. This presents a chance for brokers to interact with potential clients. Due to this fact, the supply of medical insurance is anticipated to learn the life insurance coverage enterprise as nicely.

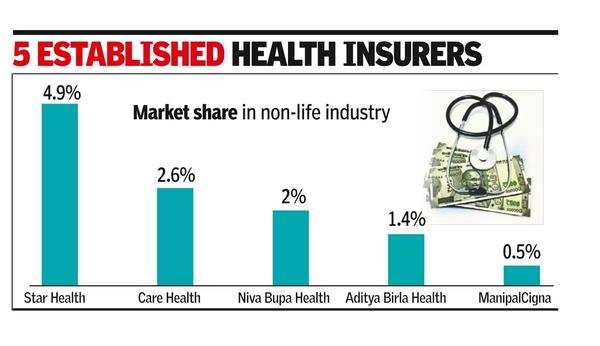

At current, there are 5 established standalone medical insurance firms — Star Well being & Allied Insurance coverage, Niva Bupa, Aditya Birla Well being Insurance coverage, Care Well being Insurance coverage and ManipalCigna Well being Insurance coverage. The regulator has additionally just lately granted permission to 2 different well being insurers — Galaxy Well being and Narayana Well being.

LIC on Thursday reported a 9.6% enhance in internet revenue for the June quarter, reaching Rs 10,461 crore in comparison with Rs 9,544 crore in the identical interval final 12 months.

The company’s market share of first 12 months premium revenue rose to 64%, up from 61.4% year-over-year. Within the particular person enterprise section, LIC held a 39.3% market share, whereas it dominated the group enterprise with a 76.6% share.

Complete premium revenue for the quarter elevated by 15.7% to Rs 1,13,770 crore, in comparison with Rs 98,363 crore in the identical quarter final 12 months. The person enterprise premium grew by 7.04% to Rs 67,192 crore, whereas the group enterprise premium rose by 30.9% to Rs 46,578 crore.

The worth of latest enterprise for the quarter grew by 23.7% to Rs 1,610 crore, and the VNB margin improved by 20 foundation factors to 13.9%. LIC’s property underneath administration elevated by 16.2% year-over-year, reaching Rs 54 lakh crore. Moreover, LIC’s solvency ratio improved to 2, up from 1.9 within the earlier 12 months. The general expense ratio decreased by 98 foundation factors to 11.9%, reflecting improved operational effectivity.

[ad_2]

This Submit could include copywrite