[ad_1]

As many of those claims are associated to hygiene situations within the locality they’re avoidable to a big extent.Nonetheless, they affect all segments of society as evident from claims knowledge.

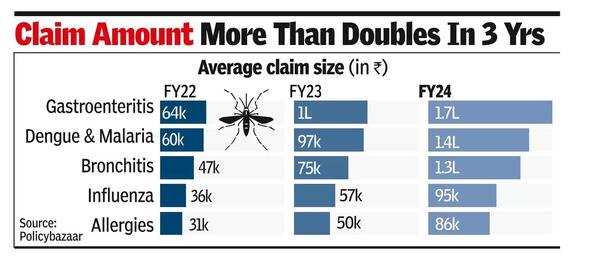

In keeping with a examine of reported medical insurance claims by Policybazaar, vector borne illnesses like Dengue and Malaria account for 15% of whole seasonal diseases claims. The price for treating these mosquito-borne illnesses usually ranges from Rs 50,000 to Rs 1,50,000. These claims surge in July and August when humid situations create ultimate breeding grounds for mosquitoes.

One other sickness that peaks in the course of the monsoon is gastroenteritis or abdomen flu which has the identical remedy bills as Malaria. This ailment accounts for 18% of seasonal claims. One other 10% of seasonal sickness claims are on account of allergic reactions the place the periodicity varies based on area. Winter sees claims on account of influenza and bronchitis peaking to twenty% and 12% of seasonal diseases. Nonetheless, the price of remedy is decrease starting from Rs 25,000 to Rs 1 lakh.

“When you take a look at developed nations, the share of seasonal diseases is way decrease in comparison with growing nations. In case of India, even in developed components of the nation like Gurgaon there are issues of water accumulation and mosquito breeding which results in a rise in these claims,” mentioned Siddharth Singhal, head of medical insurance, Policybazaar.

“These seasonal diseases add to the frequency of claims. Nonetheless, the typical declare quantity is way decrease than continual diseases, and when it comes to worth, the share of claims can be under 20%,” mentioned Singhal. In keeping with Singhal, the instances of hospitalisation for diseases that may have earlier been handled at house have gone up. “It is a optimistic growth as it’s at all times good to have skilled assist. ,” he mentioned.

[ad_2]

This Publish might comprise copywrite