[ad_1]

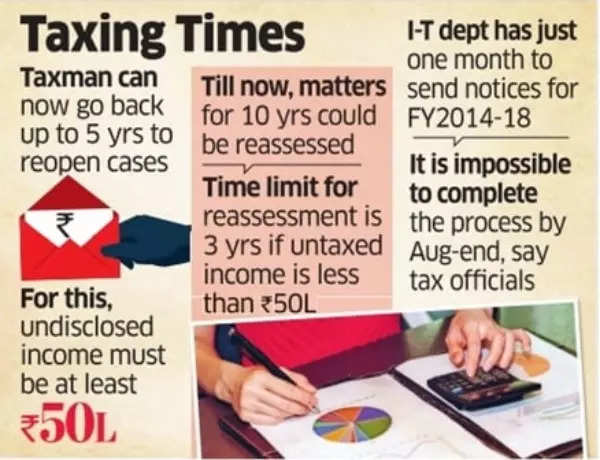

Based on the amended regulation introduced in Price range 2024, the tax authorities can solely return a most of 5 years to reassess a taxpayer’s information if the escaped earnings is a minimum of Rs 50 lakh, and three years for an quantity lower than Rs 50 lakh.Beforehand, they may reassess circumstances as much as 10 years outdated.

Based on an ET report, tax officers at the moment are confronted with the problem of compiling and corroborating information on tax and earnings mismatches for the monetary years 2013-14 to 2017-18 inside the subsequent few weeks, as these years will turn into time-barred for reassessment from September 1, 2024.

The I-T division depends on info from numerous sources, equivalent to banks, property registrars, and search findings from the investigation wing, to construct reassessment circumstances.

Taxing Instances

A tax officers’ physique has raised considerations in regards to the feasibility of issuing notices underneath Part 148 (or 148A) in numerous circumstances inside a single month, given the overburdened nature of the jurisdictional assessing officers and the time-consuming strategy of acquiring sanction from the chief commissioner, who’s the required authority for such notices.

Furthermore, the regulation offers taxpayers with the fitting to clarify their place earlier than reassessment orders are finalized, a course of that the majority consider can’t be accomplished by the top of August.

Additionally Learn | ITR refund status for FY 2023-24: How to check income tax refund status online – here’s a step-by-step guide for incometax.gov.in & NSDL websites

The Central Board of Direct Taxes (CBDT) has been urged by its officers to postpone the efficient date of the proposed modification. Nevertheless, this suggestion is unlikely to be well-received by companies and excessive web value people.

“Capping the reassessment interval at 5 years was an awesome determination as it might cut back hassles and litigation. But when the division fears there could possibly be a real lack of income because it is probably not doable to wrap up a number of issues by August 31, the federal government can consider strict parameters the place time-bound circumstances may be selectively reopened – based mostly on trails of steps taken in figuring out escaped earnings,” mentioned Mitil Chokshi, companion at CA agency Chokshi & Chokshi.

“Taxpayers could count on a rush of reassessment notices in August 2024. These notices are more likely to be for the AYs 2018-19 and previous to that. It’s pertinent to notice that the Bombay Excessive Courtroom in a current ruling in a case of Hexaware Applied sciences has taken a view on a proviso launched in 2021, which may be interpreted to imply that AY 2017-18 (and prior years) acquired time barred on March 31, 2024. These reassessment notices (for AYs 2017-18 and prior) are more likely to rake up new interpretation points within the already muddled reassessment provisions,” mentioned Ashish Mehta, companion at regulation agency Khaitan & Co.

The present state of affairs is much like the battle between the Earnings Tax workplace and taxpayers in 2021. The reassessment regulation was amended in April 2021, permitting the tax workplace to reopen 10-year-old tax returns if the full undisclosed earnings exceeded Rs 50 lakh and reassess 4-year-old issues if the quantity was lower than Rs 50 lakh.

Additionally Learn | Latest NPS rules 2024: How much tax will you save with new NPS contribution benefit under new regime after Budget 2024?

Nevertheless, this variation led to over 10,000 writ petitions being filed by corporations, arguing that they weren’t given adequate time to clarify and that the notices had been issued with out contemplating the carve-out that circumstances which could not be reopened earlier could not be reassessed underneath the brand new regulation.

The Supreme Courtroom invoked its extraordinary powers underneath Article 142 of the Structure on Could 4, 2022, to uphold all reassessment notices issued after March 31, 2021. Nevertheless, the courtroom left room for judicial proceedings based mostly on the deserves of every case, and several other such issues are at the moment pending earlier than the courtroom.

[ad_2]

Source link

This Submit could include copywrite