[ad_1]

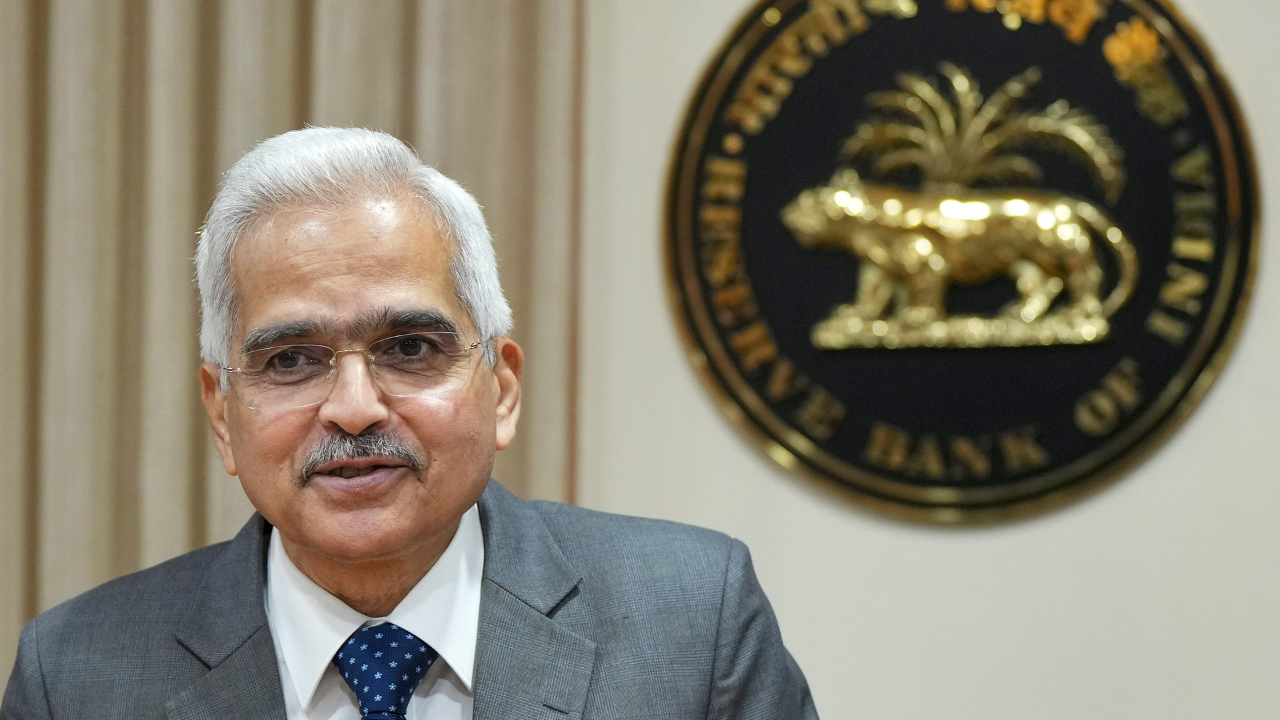

“The financial coverage committee determined by a 4:2 majority to maintain the coverage repo fee unchanged at 6.5%. Consequently, the standing deposit facility (SDF) fee stays at 6.25%, and the marginal standing facility (MSF) fee and the financial institution fee at 6.75%,” RBI governor Shaktikanta Das mentioned in a presser on Thursday.

That is the ninth time in a row that the MPC has saved repo fee unchanged at 6.5%.

The MPC determined to take care of its stance of ‘withdrawal of lodging’ with a purpose to consider guiding inflation in direction of the specified goal. This resolution was supported by a majority vote, with 4 out of the six members backing the stance.

The MPC has maintained the repo fee at 6.5 % since February 2023.

The MPC’s major accountability is to set the coverage repo fee to realize the inflation goal of 4 % whereas contemplating the target of financial development.

The present MPC is ready to bear vital modifications this yr.

The phrases of the three exterior members will conclude on October 6 and can’t be renewed.

The six-member financial coverage committee (MPC), which incorporates three central financial institution officers and three exterior members, is recast each 4 years when the federal government appoints a brand new set of exterior members.

The opposite three members of the MPC embrace RBI governor Shaktikanta Das, whose present time period ends in early December, deputy governor Michael Patra, whose contract runs till early January, and govt director Rajiv Ranjan.

The exterior members of the rate-setting panel are Shashanka Bhide, Ashima Goyal, and Jayanth R Varma.

(With inputs from businesses)

[ad_2]

This Submit could include copywrite