[ad_1]

Sebi chief and her husband, by 360 One WAM (IIFL’s wealth administration arm), had allegedly invested in World Dynamic Alternatives Fund, the identical fund that Vinod Adani, elder brother of Gautam Adani, had used to spend money on Adani group’s shares, Hindenburg mentioned.The Adani group has refuted all of Hindenburg’s allegations.

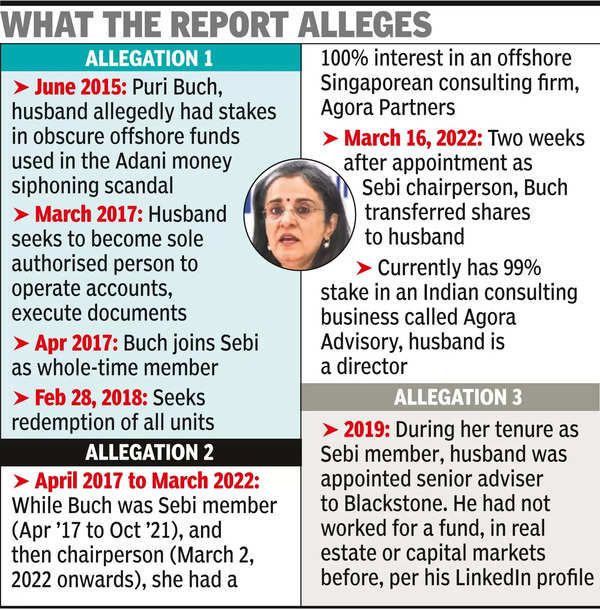

The report that was launched late Saturday night alleged that Sebi’s “drew a clean” in its probe towards Adani because of the alleged investments by Buch and her husband within the offshore funds. In March 2017, earlier than Buch was appointed Sebi member, Dhaval wrote to the Mauritius fund administrator informing that he would turn into the only real individual to function the account. Subsequently, in Feb 2018, after becoming a member of Sebi, Buch purportedly sought to redeem all of the models held with the Fund, Hindenburg mentioned. A Sebi spokesperson didn’t reply to a request for remark, whereas a spokesperson for 360 One WAM declined remark.

Not a lot ‘substance’ in Hindenburg report, say market veterans

Hindenburg’s newest report additionally identified that between April 2017 and March 2022, when Buch was a whole-time member at Sebi after which its chief, she allegedly had a 100% curiosity in an offshore Singaporean consulting agency referred to as Agora Companions. On March 16, 2022, two weeks after her appointment as Sebi chairperson, she “quietly transferred the shares to her husband”, the report alleged.

“This offshore Singaporean entity is exempt from disclosing monetary statements so it’s unclear the quantity of income it derives from its consulting enterprise and from whom — essential info for these assessing the probity of the chairperson’s exterior companies pursuits.”

However she allegedly continued to retain 99% stake in Agora Advisory Pvt Ltd, an Indian consulting agency, the place her husband is a director. In 2022, it reported revenues of $261 million (round Rs 2,000 crore)

“Conclusion: Battle or seize? Both method, we don’t assume Sebi might be trusted as an goal arbiter within the Adani matter,” Hindenburg mentioned, whereas calling for additional probe.

The report additionally mentions that whereas Buch was a whole-time member at Sebi, her husband was appointed a senior adviser to Blackstone in 2019. “He had not labored for a fund, in actual property or capital markets earlier than, as per his LinkedIn profile,” it mentioned, whereas alleging a battle of curiosity.

On its half, on June 27 this 12 months Sebi had issued a showcause discover to Hindenburg, alleging poor disclosures about their quick positions in Adani shares.

Utilizing whistleblower paperwork, Hindenburg on Saturday mentioned that Buch and her husband Dhaval first appeared to have opened their joint account with one offshore fund on June 5, 2015, in Singapore. “A declaration of funds, signed by a principal at IIFL states that the supply of the funding is ‘wage’ and the couple’s web price is estimated at $10 million,” the report mentioned.

Hindenburg mentioned that after it launched its preliminary report towards Adani group that inside 5 weeks wiped off about 65% of the group’s market worth it was stunned by the regulator’s actions that failed to search out faults with the ports-to-FMCG group. “What we hadn’t realised: the present Sebi chairperson and her husband had hidden stakes in the very same obscure offshore Bermuda and Mauritius funds, present in the identical advanced nested construction, utilized by Vinod Adani,” it mentioned.

“We suspect Sebi’s unwillingness to take significant motion towards suspect offshore shareholders within the Adani Group could stem from (Sebi) chairperson Madhabi Buch’s complicity in utilizing the very same funds utilized by Vinod Adani, brother of Gautam Adani.”

Following the controversy that erupted submit the Hindenburg report was revealed, Sebi began its personal investigations into the allegations. On the similar time, regardless of strain from the opposition at Parliament, the government declined to refer the case to a joint parliamentary committee (JPC). However a swimsuit within the Supreme Courtroom was filed which directed Sebi to research below its instructions.

Later in 2023, the Supreme Courtroom had mentioned that Sebi had “drawn a clean” in its investigations into who funded Adani’s offshore shareholders. “If Sebi actually needed to search out the offshore fund holders, maybe the Sebi chairperson might have began by wanting within the mirror,” Hindenburg’s newest report mentioned. “We discover it unsurprising that Sebi was reluctant to observe a path which will have led to its personal chairperson.”

Market veterans, fund managers and institutional merchants TOI spoke to, nevertheless, mentioned that though optically the report was extremely damaging to Sebi and its chief, there was not a lot ‘substance’ in it. Indians who open offshore accounts use IIFL’s automobiles which largely spend money on a segregated method. “These automobiles aren’t commingled,” mentioned an offshore dealer.

[ad_2]

This Put up could include copywrite