[ad_1]

Sebi has requested traders to take an knowledgeable determination earlier than reacting to such experiences.”It’s emphasised that Sebi has satisfactory inner mechanisms for addressing points referring to battle of curiosity, which embrace disclosure framework and provision for recusal. It’s famous that related disclosures required when it comes to holdings of securities and their transfers have been made by the chairperson infrequently. The chairperson has additionally recused herself in issues involving potential conflicts of curiosity,” Sebi stated.

Sebi launch additionally, intimately, produced related knowledge, to disclaim Hindenburg’s allegations that the regulator had not taken any motion towards Adani Group. The report had additionally questioned Sebi’s motion of issuing a show-cause discover to the US-based short-seller.

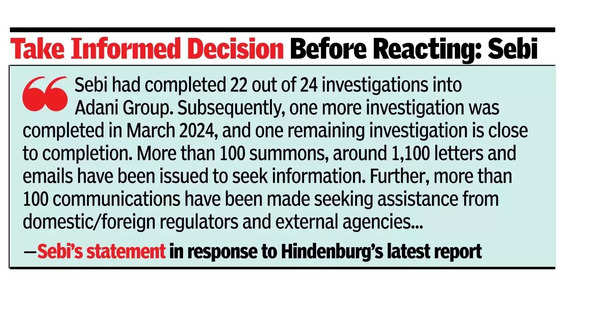

“…Sebi had accomplished 22 out of 24 investigations into Adani Group. Subsequently, yet another investigation was accomplished in March 2024, and one remaining investigation is near completion. Throughout the ongoing investigation on this matter, greater than 100 summons, round 1,100 letters and emails have been issued to hunt info. Additional, greater than 100 communications have been made in search of help from home/overseas regulators and exterior businesses. Additionally greater than 300 paperwork containing round 12,000 pages have been examined,” it stated, including that enforcement proceedings have additionally been initiated the place the probe has been accomplished.

On June 27, Sebi’s show-cause discover to Hindenburg had, amongst different points, identified that earlier than the discharge of Hindenburg first report towards Adani Group on Jan 24, 2023, a fund run by Kingdon Capital had constructed brief positions within the group’s firms. These positions have been constructed primarily based on a report by Hindenburg that was shared with the fund earlier than it was launched publicly.

The positions have been squared off by Feb 22, 2023, at a revenue of about Rs 183 crore. As a part of the deal, Hindenburg acquired a 25% revenue from Kingdon Capital.

Sebi believed such features have been unlawful and therefore had issued to Hindenburg and another associated entities as to why authorized actions shouldn’t be initiated towards them. Sebi had additionally requested the entities to disgorge these ill-gotten features.

There are a number of folks available in the market who consider that Hindenburg’s newest report towards the Sebi chairperson was primarily to get again to the regulator for issuing the show-cause discover .

In its launch, Sebi additionally denied it had modified any laws for REITs “to profit a diversified multinational monetary conglomerate”. Hindenburg had alleged that some modifications to guidelines have been made to profit international monetary large Blackstone since Dhaval Buch, husband of Sebi chairperson, was employed by its India arm.

[ad_2]

This Put up could include copywrite