[ad_1]

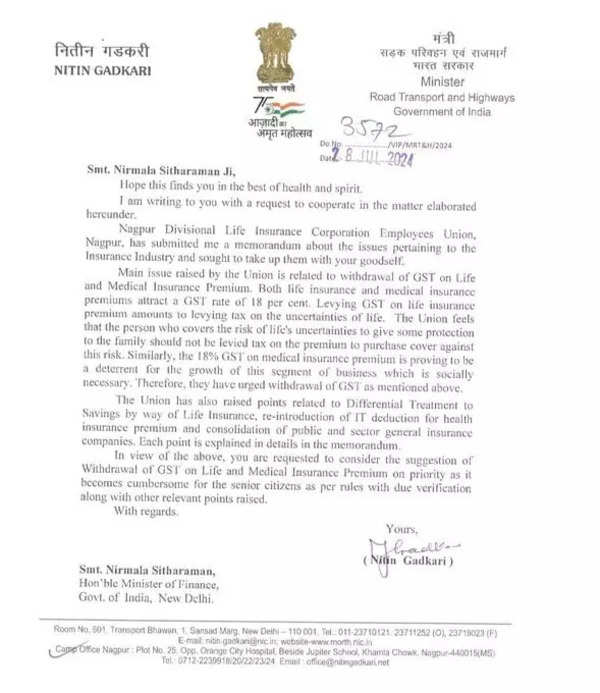

Within the letter addressed to the FM, Gadkari stated: “Important subject raised by the Union is expounded to withdrawal of GST on Life and Medical Insurance coverage Premium.Each life insurance coverage and medical insurance coverage premiums entice a GST price of 18 per cent. Levying GST on life insurance coverage premium quantities to levying tax on the uncertainties of life.”

“The Union feels that the one who covers the chance of life’s uncertainties to offer some safety to the household shouldn’t be levied tax on the premium to buy cowl towards this danger. Equally, the 18% GST on medical insurance coverage premium is proving to be a deterrent for the expansion of this section of enterprise which is socially essential. Due to this fact, they’ve urged withdrawal of GST as talked about above,” he added.

The minister famous that the Union has put forth a number of options, together with the availability of Differential Therapy to Financial savings by means of Life Insurance coverage insurance policies. Moreover, they’ve advocated for the reinstatement of Earnings Tax deductions for medical health insurance premiums paid by people.

Moreover, the Union has proposed the consolidation of public and sector basic insurance coverage firms, with the purpose of streamlining operations and bettering effectivity within the insurance coverage trade.

“In view of the above, you’re requested to think about the suggestion of withdrawal of GST on life and medical insurance coverage premium on precedence because it turns into cumbersome for senior residents as per guidelines with due verification,” he added.

The Union highway transport and highways minister wrote the letter following the Nagpur Divisional Life Insurance coverage Company Staff Union’s submission of a memorandum to the minister. The memorandum sought motion on points affecting the insurance coverage trade.

[ad_2]

Source link

This Publish might include copywrite