[ad_1]

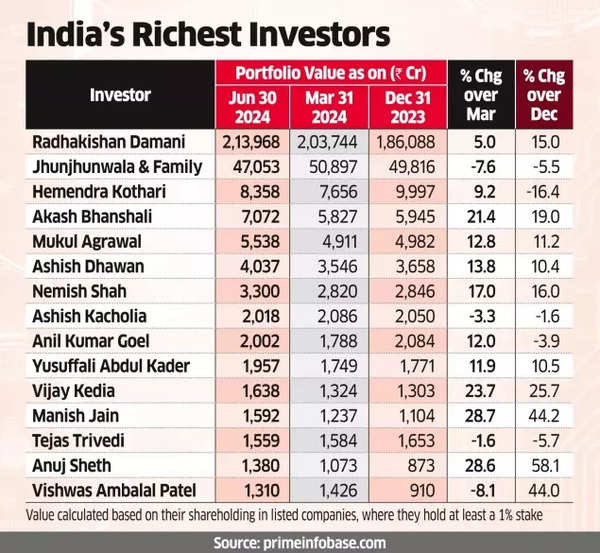

The rankings are decided primarily based on their shareholdings in listed corporations the place they maintain a minimal of 1% stake.

Hemendra Kothari’s portfolio noticed a acquire of over 7%, primarily because of the robust efficiency of Alkyl Amines Chemical substances and EIH Related Accommodations. Regardless of this improve, his portfolio stays 16% decrease in comparison with the top of December.

Akash Bhanshali’s portfolio skilled a considerable acquire of over 21%, with Sudarshan Chemical substances and Ramkrishna Forgings rising by 48% and 29%, respectively.

India’s Richest Buyers

Equally, the portfolios of Mukul Agrawal, Ashish Dhawan, and Nemish Shah noticed will increase of 13%, 14%, and 17%, respectively, in the course of the June quarter, outperforming the Nifty index, which gained 3.81%.

Vijay Kedia’s portfolio stood out as one of many largest gainers, rising by 24% to achieve Rs 1,638 crore. The spectacular efficiency was pushed by the surge in Tejas Networks, which skyrocketed by 115% within the June quarter, together with vital rallies in Atul Auto, Elecon Engineering, and Sudarshan Chemical substances, which rose between 32% and 48%.

Manish Jain’s portfolio additionally skilled a outstanding acquire of 29%, reaching Rs 1,592 crore. Three of his shares, particularly Linde India, Hester Bioscience, and Profession Level, noticed substantial will increase of 30%, 72%, and 41%, respectively.

The Jhunjhunwala household‘s wealth in listed companies, which had exceeded Rs 50,000 crore within the March quarter for the primary time, noticed a lower of practically 8% to Rs 47,053 crore by the top of the June quarter.

This decline was attributed to the autumn in shares akin to Titan, Crisil, and Solar Pharma Superior Analysis, which dropped between 10% and 35% in the course of the interval.

[ad_2]

This Publish might comprise copywrite